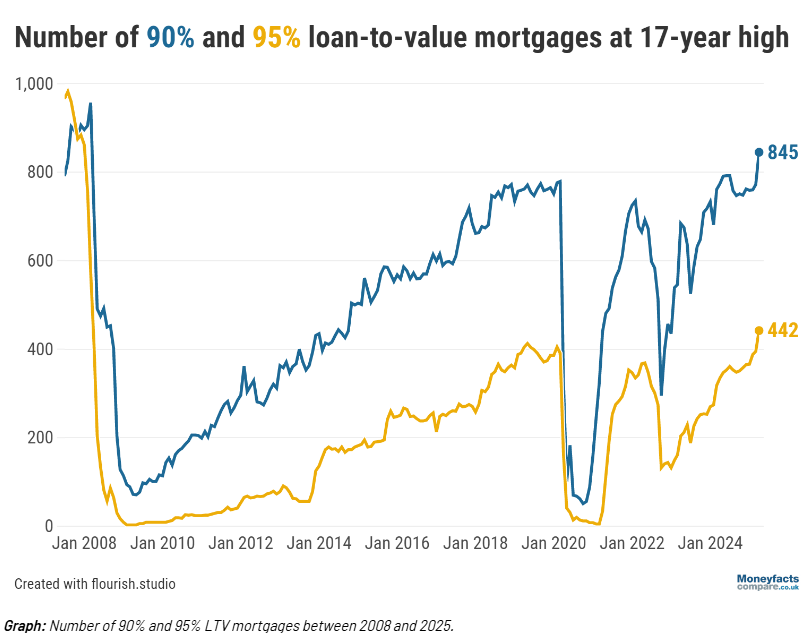

Low-deposit mortgage deals highest for 17 years

First-time buyers now have more high loan-to-value mortgages to choose from, and increased time to secure deals.

According to the latest data from the Moneyfacts UK Mortgage Trends Treasury Report, the number of first-time buyer mortgages on the market has risen monthly.

The availability of mortgages able to finance up to 90% loan-to-value (LTV) rose in the month of April from 772 to 845, while the number of 95% LTV deals increased to 442, up from 395 the month prior.

This marks a 17-year high for both figures, as the number of 90% and 95% LTV deals was recorded at 957 and 575, respectively, in March 2008.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, says: “The Government has been clear that it wants lenders to do more to boost UK growth, and so a rise in product availability for aspiring homeowners is a healthy step in the right direction.”

Moneyfacts data shows that 95% LTV mortgages account for just over 6% of the total number of fixed and variable deals available to borrowers. Also, the overall market saw a rise in mortgage product availability, growing from 6,684 at the beginning of March to 6,870 by the start of April.

Source: Moneyfacts

Call Trinity Financial on 020 7016 0790 to secure a mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage